For several years now, Australian shoppers have been keen to understand the provenance of purchases.

It may be out of concern for locally sustainable or ethical sourcing, or it may simply be for health reasons, but people want to know what they’re eating.

But provenance is a complex problem.

In grocery, the major supermarket chains are trying to understand how - particularly fresh - product moves from ‘farm to fork’, or from ‘paddock to plate’.

Woolworths’ efforts were revealed in mid-2018, with the retailer telling an industry forum that it was looking to place sensors at strategic points in the end-to-end supply chain, measuring everything from how much sunlight and water crops receive and how long it takes to transport to “how bumpy the roads are”, the latter an effort to understand and minimise damage (and therefore food waste).

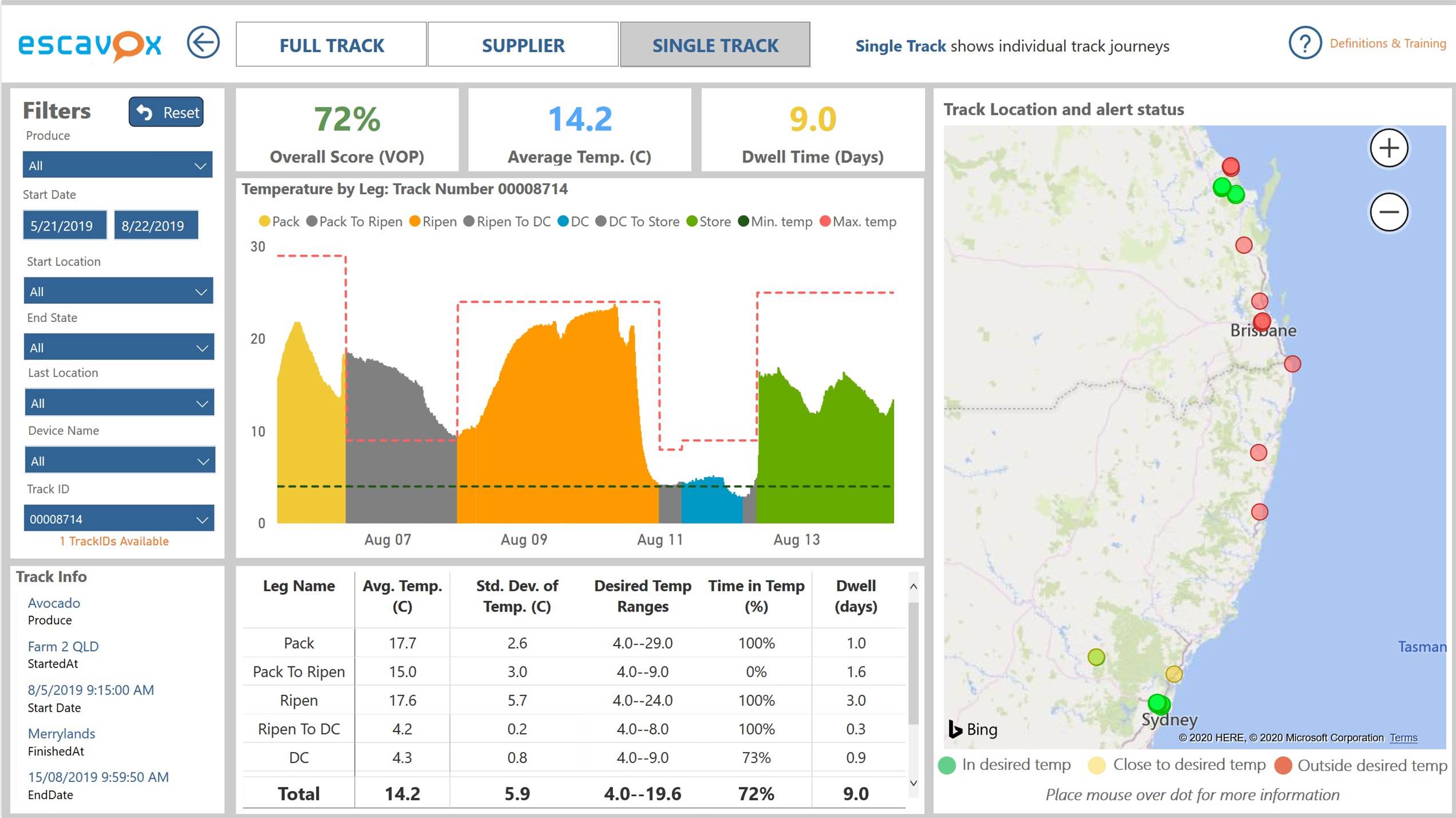

Some of the technology used by Woolworths comes from start-up Escavox, whose director Luke Wood spent several years working on innovation and transformation in Woolworths’ supply chain.

Wood tells IoTHub.com.au that Escavox now has a fleet “in the tens of thousands” of IoT devices. These boxes collect and relay data as fresh produce moves through the supply chain, generating insights and knowledge that is used to optimise agricultural, transportation and product-handling practices.

“Retailers and producers are all wrestling with how to solve ‘farm to fork’ provenance, tracking and traceability issues," says Wood.

Different parts of the retail supply chain are tackling the challenges in their own way and have their own unique requirements.

We're still ‘bleeding edge’ for the producer side of the equation in terms of them viewing their downstream supply chain. Growers and the producers are still 'toe in the water' with a lot of new technology. They use a lot of IoT and remote technology on-farm, but very little in their supply chain, so we're helping them to fill their supply chain gap.

While retailers are more likely to be experimenting with - or adopting - real-time supply chain tracking, they are often still nervous and uncertain about how they can put the data collected to good use.

“There's a lot of people with reams of data that don't really know what to do with it, who aren’t handling, processing and converting it into anything of value,” Wood says.

Escavox is filling that gap. “We’re a knowledge company in the fresh food industry that happens to use IoT and technology to gather information. We talk about gathering the actual data, to create valuable information, to gain knowledge, to create wisdom - a classic knowledge pyramid.”

Tracking Coles and Woolworths

Grocery retailing in Australia - particularly between the two dominant players - is highly competitive.

That’s traditionally been cause enough to keep quiet on innovation. But with both majors now powering digital innovation through specific vehicles - think Woolworths’ WooliesX and Coles’ Lab288 - some of that reticence is starting to subside.

Still, both aren’t giving much away when it comes to their IoT ambitions.

Woolworths appeared to give away some clues in a recent job listing, where it recently sought someone with “a depth and breadth of understanding of IoT technology stack, solutions and products” and “IT and OT infrastructure engineering/design … in large scale environments” to “convert esoteric business requirements to sound, scalable technical products and solutions; and build digital infrastructure, IoT and innovation proof-of-concepts at speed”.

A Woolworths spokesperson, however, told IoTHub.com.au the listing was an “error”.

“At this stage, we are not exploring significant IoT investments within supply chain to warrant this kind of role,” the spokesperson said.

“We continue to evaluate the opportunities that IoT can bring to our business, but there is no progression on any specific use cases at present.”

On its ongoing use of Escavox, the spokesperson added, “We're closely monitoring Escavox's progress and continue to facilitate produce tracker collection as part of its current trials.”

Coles chief information and digital officer Roger Sniezek confirmed Coles is also doing some ‘farm to fork’ work. “We're working on quite a number of things aimed at how can we make sure that things are fresher, all the way through our supply chain,” he says, before adding, “Probably nothing that we can talk about this stage.”

Sniezek said Coles is making use of wearable technology that straps a barcode scanner to the back of staff’s hands.

“That allows them to very simply scan the barcodes of things as they come in or if they're in the backroom of the store, and the beeping then tells them exactly what needs to be done with those products,” he says.

“It sounds pretty small but when you consider the number of cases and cartons we've got moving through our stores all day every day, the volumes become pretty enormous.”

Coles has also looked at a few different ways to enable real-time replenishment on out-of-stock items using a variety of IoT-related solutions, such as by combining cameras and machine vision, or by using sensors.

Those experiments are continuing, though it appears there could be much simpler - non-IoT - ways to solve the challenge.

“With some of these problems, you do some research and then find different ways that are maybe simpler to achieve the outcome,” says Sniezek.

There was still value in running the experiments, even if they did not result in production deployments.

"By doing the experiments, it gives you a lot of insight data, so that then you know how accurate your alternative mechanism is. For example, we've [since] built a system that uses some interesting AI to look at lost sales during the day. It can tell you where you are, have been or are very likely to be out of stock, without having to use cameras. It's just using all of the data that we've got."

– Coles chief information and digital officer Roger Sniezek

Looking further afield

IoT in retail is, of course, a broader play than the grocery chains.

Myer, for example, piloted radio-frequency identification (RFID) tags on Apple merchandise in a single store, cutting stocktake times from 2.5 hours a day to 15 minutes while reducing shrinkage caused by “theft and inadequate inventory control”.

Retail has also often been associated with IoT use cases such as proximity-based marketing, where passing shoppers can be alerted to a sale or provided other contextually-aware, personalised messaging. However, it is difficult to cite actual production uses of the technology in Australia.

In addition, as IoT continues to mature, it is enabling new retail channels to open. Analyst firm Telsyte predicts it will create a new “paradigm for digital commerce” in the next decade, as people order directly from their smart home appliances.

“Telsyte defines this as IoT-Commerce which encapsulates purchases enabled or facilitated by smart appliances (e.g. smart fridges) and other IoT@Home products such as smart speakers,” the firm said. “While its early days, Telsyte predicts IoT-Commerce will become mainstream within 10 years’ time.”