Sydney company Envirosuite has announced acquisition plans which would create a group supplying air, noise, vibration and water management solution in more than 40 countries.

The company has signed an agreement to buy Melbourne-based EMS Bruel & Kjaer Holdings (EMS), which sells noise and vibration monitoring technology around the world.

The price includes a $70 million cash payment, which Envirosuite plans to raise through a share placement. The acquisition is subject to shareholder approval.

EMS’s solutions are used at more than 200 airports and in construction and infrastructure operation. They include solutions for tracking 'noise envelopes' of individual planes and their effect on surrounding communities. The company was founded in 1990 as Lochard.

EMS is expected to record over $47 million in top-line revenue for the 2019 calendar year, according to Envirosuite. Macquarie Corporate Holdings and instrument and controls company Spectris are majority EMS shareholders.

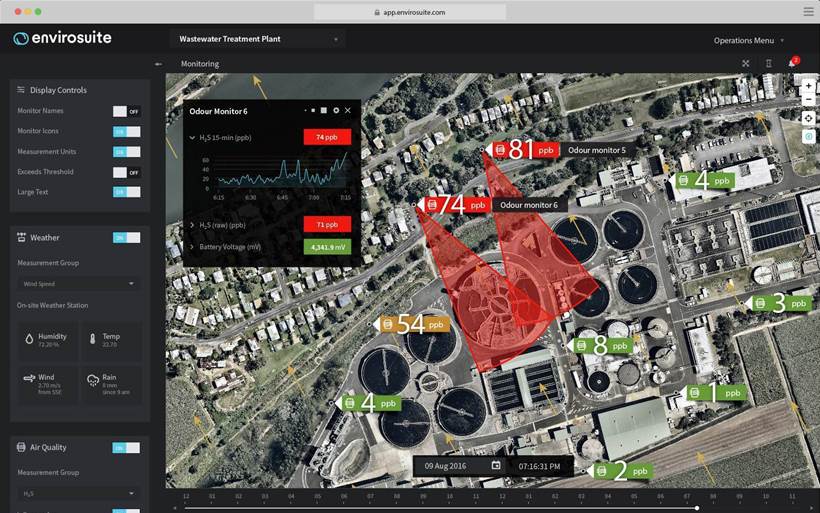

Envirosuite offers an AWS-hosted, real-time environment management platform, which is used in mining, water and waste management and by heavy industry, ports, agricultural and government organisations. Users have included BHP, Rio Tinto, Anglo American, Thames Water, the Port Authority of NSW and air quality management agencies operating in San Francisco and Los Angeles.

Envirosuite’s uses include environmental compliance, blast management, impact modelling, source identification and risk management.

Together, the two companies have 280 staff.

If the acquisition goes ahead, Envirosuite sees up-sell and cross-sell opportunities in the mining, smart city, airport, waste and wastewater, construction and heavy industry sectors.

It also sees opportunity to grow its business geographically. Envirosuite has offices in Australia, Canada, Chile, Colombia, Spain and China, while EMS has offices in Australia, the US, Denmark, Spain and Taiwan.

“Australia has been at the forefront of environmental monitoring technology and we will now have the people and footprint to be able to establish a world-leading offering,” stated Envirosuite Chief Executive Office Peter White on the company’s website.

Demand for continuous environment monitoring is partly driven by adoption of industry best practice, according to White. Other demand drivers also include public community consultation, rising regulatory concerns and an increase in high-density living, he added.

A shareholder meeting is expected to take place in February.The acquisition is expected to complete on or around 28 February 2020, according to Envirosuite.