It’s been four years since we launched IoT Hub and to celebrate our birthday we’re looking back at some milestones.

When we started writing about IOT in 2015 you could still connect to 2G services and AWS was asking potential customers if they'd heard about IoT.

Since then, we’ve seen low bandwidth networking proliferate, 5G arrive, nanosatellites launch and a smorgasbord of cloud IoT services appear.

And while many local IoT deployments have been limited in scale, we’ve seen some organisations push the technology further – Woodside Energy’s use of 200,000 sensors in a big data project is one example.

Below, you can read about these and other IoT milestones we’ve covered since 2015. It’s not an exhaustive list, so feel free to offer suggestions at the bottom of the page.

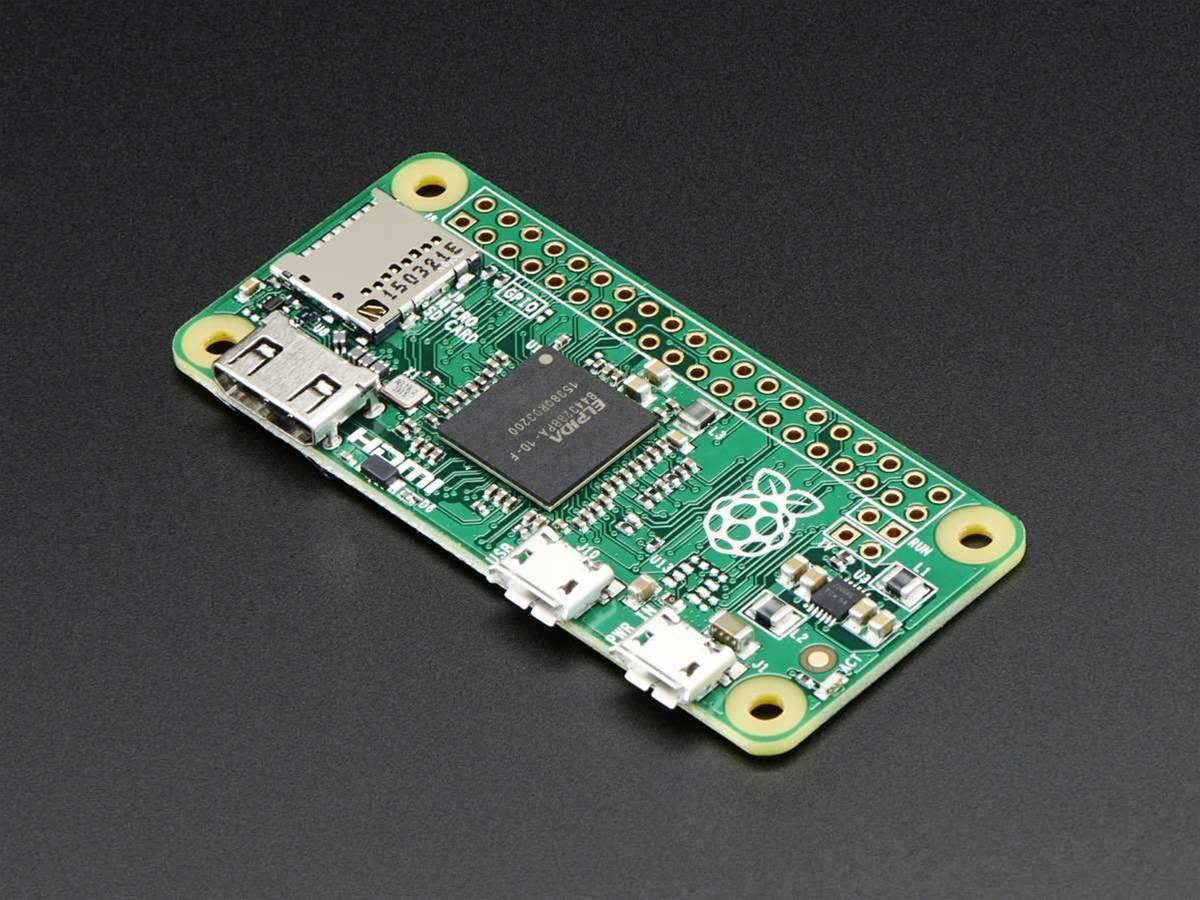

- The Raspberry Pi single-board computer might not look like much, but it’s enabled countless IoT experiments. In 2015 the board got even smaller and cheaper with the arrival of the Raspberry Pi Zero. The new model measured 65mm x 30mm form factor and cost $19.20.

- The Mirai botnet attack in late 2016 provided compelling evidence that poor IoT security was creating serious business risks. Attackers reportedly scanned devices for default passwords, giving them control of enough devices to take down services such as PayPal, Spotify and Twitter.

- Intel stepped up its IoT activities in 2016, announcing a string of partnerships and initiatives. That included collaborations with Ericsson, LG Electronics, Nokia, Verizon and others to develop 5G solutions and technologies. It also declared plans to invest US$250 million in autonomous vehicle-related ventures.

- The same year, oil and gas company Woodside Energy showed how far industrial IoT had progressed, when it revealed it was analysing data from 200,000 sensors at a liquefied natural gas plant. And that was just a pilot – the company later announced plans to extend its use of IoT and big data to additional sites.

- KPMG Australia showed that IoT had become serious business in mid-2016, when it created its IoT practice. The consultancy pointed to the Australian Government’s $50 million smart city fund as an example of IoT momentum.

- Sigfox’s Low Power WAN (LPWAN) service is an important part of the IoT landscape, but just a few years ago it wasn’t even available in Australia. That changed in early 2016 when Sigfox announced a partnership with Thinxtra to bring its network to Australia and New Zealand. By July, the network was available in Sydney, Melbourne and Auckland. And by November, Thinxtra was offering a free connectivity to councils.

- Privacy concerns gained credence in 2016 when we learned that 71 percent of surveyed Australian IoT suppliers did not adequately explain how they collected, used and disclosed personal information.

- Google Home wasn’t the first voice activated, Internet-connected consumer device for Australian homes, but its arrival here in 2017 helped popularise the category.

- Adelaide start-up Myriota highlighted how low earth orbit satellites could solve some connectivity problems in 2017, when it deployed its credit card-size satellite interface device for the first time – using it to enable remote monitoring of water tanks on rural properties. Less than a year later, the company raised SU$15 million from investors.

- Meanwhile, another Adelaide-based satellite communications company was also kicking goals. Fleet Space Technologies secured $5 million in funding in 2017 and went on to secure a partnership with Kennards Hire, which is working an asset-tracking project. It also attracted another US$7.35 million in funding recently.

- The Australian Government got local councils jumping up and down about IoT in 2017, when it dangled $50 million in smart city funding. A total of 176 councils competed for the money in the first round of funding.

- Telstra improved IoT connectivity options in early 2018, when it turned on its NB-IoT service. The carrier said the new service would suit applications that sent smaller amounts of data than CaT-M1, which launched one-and-a-half years earlier and was capable of “100s of kilobits per second”.

- Express Logic may not be a household name, but that doesn’t mean it isn’t significant. The company makes the ThreadX Real Time Operating System, which is used in billions of industrial devices such as air conditioners and temperature gauges. Microsoft bought the company this year, giving it another way to increase Azure’s reach.

- When the Barrack Place office tower in the Sydney CBD opened in 2018, it was filled with sensors intended to help lower electricity costs and manage use of the building. The owner, real estate company Investa, also owns the building at 567 Collins Street, Melbourne, which has 14,000 “live data points”.

- Smart lighting vendors must have been wetting their lips in recent years as local councils poured money into the technology. For example, City of Darwin is spending $1.6 million on 10,000 wireless LED lights it started deploying this year. The lights will connect to a wireless network and the council intends to use the light poles as hubs to connect other devices.

- Transport for NSW has been collecting data about the movement of its trains for years, but use of that data stepped up a gear in 2019. Downer EDI, which maintains Sydney’s trains, is attempting to analyse huge amounts of data generated by train sensors. The data is being fed to an Azure-based platform for analysis, which Downer EDI hopes will enable predictive maintenance.

- Connected car trials took another step forward this year, with cars on metropolitan and regional roads connected to speed limit and traffic light data for the first time. The trial was the first local use of 5.9GHz radios based on 4G Cellular V2X technology, which allows cars to communicate without using the mobile cellular network.

- This month, Telstra announced plans to turn off its 3G services in 2024. The shutdown will mark the end of a period of major growth in mobile data usage and will mean a round of hardware upgrades for organisations using 3G devices. Telstra said the shutdown would be necessary to make way for 5G services, which it launched late last year.